Now, the focus shifts to supply side shocks and a positive shock to labor supply is the first of the supply shocks presented in sections 10 - 14. Labor input in ADAM's production function is defined in terms of efficiency corrected labor hours, i.e. as a product of three elements: labor productivity, working hours per year per employed and employment. A change in any of these three components changes the labor input, and the three experiments of sections 10 - 12 present a shock to each of the three elements. In all cases production increases in the medium and long run. In the following, we consider the effect of a permanent increase in the number of people in the work force caused by a reduction of 27000 in the number of people outside the labor force who do not receive transfers. The work force increases approximately by 1 per cent of the total employment. (See experiment)

Table 10. The effect of a permanent increase in labor supply

| 1. yr | 2. yr | 3. yr | 4. yr | 5. yr | 10. yr | 15. yr | 20. yr | 25. yr | 30. yr | ||

| Million 2005-kr. | |||||||||||

| Priv. consumption | fCp | 773 | 1839 | 2487 | 2564 | 2242 | -1293 | -4379 | -6115 | -6720 | -6565 |

| Pub. consumption | fCo | -17 | -41 | -61 | -75 | -84 | -117 | -151 | -191 | -225 | -249 |

| Investment | fI | 604 | 1807 | 2770 | 3214 | 3312 | 2244 | 1233 | 1200 | 1734 | 2392 |

| Export | fE | 748 | 1641 | 2631 | 3706 | 4859 | 10975 | 16796 | 21627 | 25063 | 27124 |

| Import | fM | 574 | 1573 | 2310 | 2617 | 2678 | 2395 | 2787 | 3870 | 5110 | 6165 |

| GDP | fY | 1497 | 3550 | 5297 | 6513 | 7328 | 9003 | 10253 | 12131 | 14153 | 15895 |

| 1000 Persons | |||||||||||

| Employment | Q | 1.63 | 4.42 | 7.39 | 10.03 | 12.20 | 18.14 | 21.40 | 24.43 | 26.62 | 27.56 |

| Unemployment | Ul | 13.65 | 11.15 | 9.65 | 8.38 | 7.33 | 4.47 | 2.87 | 1.39 | 0.32 | -0.13 |

| Percent of GDP | |||||||||||

| Pub. budget balance | Tfn_o/Y | -0.15 | -0.12 | -0.03 | 0.06 | 0.13 | 0.28 | 0.35 | 0.45 | 0.56 | 0.65 |

| Priv. saving surplus | Tfn_hc/Y | 0.12 | 0.03 | -0.08 | -0.17 | -0.21 | -0.13 | 0.01 | 0.06 | 0.06 | 0.04 |

| Balance of payments | Enl/Y | -0.03 | -0.08 | -0.11 | -0.11 | -0.08 | 0.15 | 0.36 | 0.51 | 0.62 | 0.69 |

| Foreign receivables | Wnnb_e/Y | 0.06 | 0.05 | 0.01 | -0.03 | -0.03 | 0.57 | 2.02 | 3.93 | 6.01 | 8.08 |

| Bond debt | Wbd_os_z/Y | 0.20 | 0.34 | 0.39 | 0.35 | 0.25 | -0.65 | -1.85 | -3.29 | -4.97 | -6.79 |

| Percent | |||||||||||

| Capital intensity | fKn/fX | -0.09 | -0.20 | -0.28 | -0.33 | -0.35 | -0.38 | -0.49 | -0.65 | -0.75 | -0.78 |

| Labour intensity | hq/fX | -0.04 | -0.08 | -0.09 | -0.08 | -0.07 | -0.02 | -0.01 | 0.00 | 0.02 | 0.03 |

| User cost | uim | -0.14 | -0.26 | -0.36 | -0.44 | -0.52 | -0.83 | -1.04 | -1.14 | -1.15 | -1.10 |

| Wage | lna | -0.31 | -0.71 | -1.03 | -1.31 | -1.55 | -2.37 | -2.86 | -3.08 | -3.06 | -2.91 |

| Consumption price | pcp | -0.14 | -0.27 | -0.39 | -0.49 | -0.59 | -1.00 | -1.30 | -1.49 | -1.56 | -1.54 |

| Terms of trade | bpe | -0.10 | -0.18 | -0.26 | -0.32 | -0.38 | -0.61 | -0.75 | -0.82 | -0.83 | -0.79 |

| Percentage-point | |||||||||||

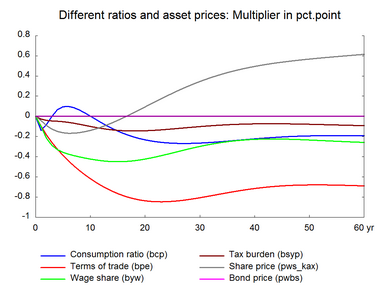

| Consumption ratio | bcp | -0.14 | -0.08 | 0.00 | 0.07 | 0.10 | 0.00 | -0.15 | -0.23 | -0.27 | -0.26 |

| Wage share | byw | -0.10 | -0.22 | -0.29 | -0.33 | -0.36 | -0.42 | -0.45 | -0.42 | -0.36 | -0.30 |

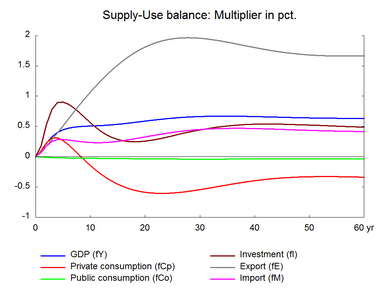

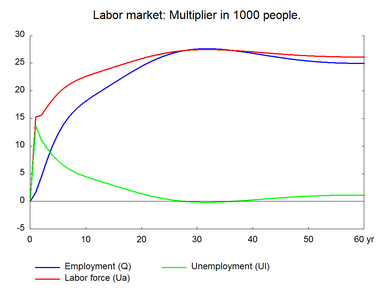

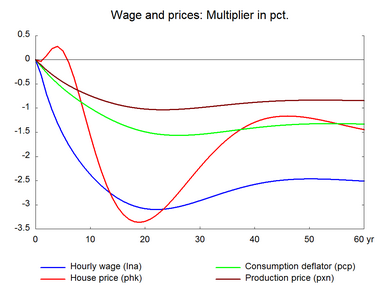

The increased labor supply is not automatically soaked up in the economy at once as there is no demand side response, so unemployment increases. The higher unemployment reduces the growth of wages and prices. The decline in prices relative to the baseline improves competitiveness, as a result production and exports increase and gradually pull the extra labor force into employment. Employment increases until the additional labor force is employed and the rate of unemployment is back at its structural level.

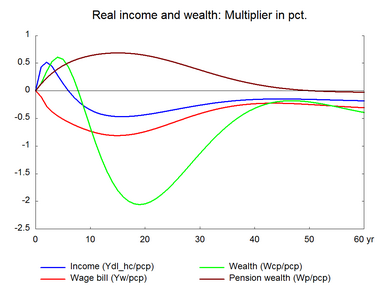

The positive effect on employment, the negative effect on wages and the positive effect on exports is permanent. Private consumption rises in the short run as the unemployed people receive unemployment benefits and other social benefits. The long term impact on private consumption is negative. This is because the lower wages reduce real wage and real disposable income permanently as import prices are unchanged.

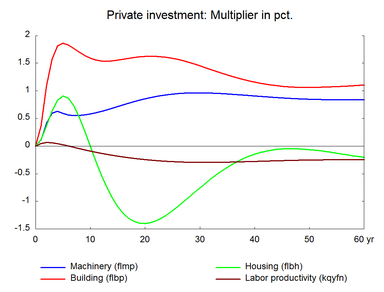

Overall, there is a positive effect on production in the long run. This is because of the permanent increase in employment. At the same time, there is also a change in relative price of production factors, and labor has become relatively cheaper. Substitution of labor for capital makes production more labor intensive and aggregate productivity falls. This offsets part of the increase in production.

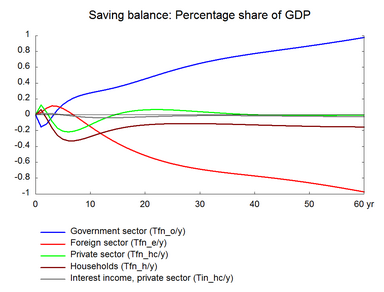

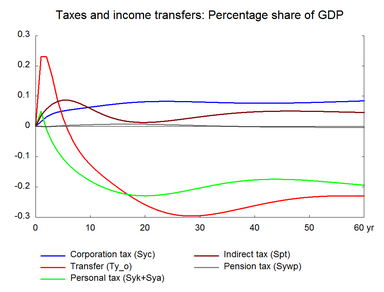

There is a significant positive effect on public budget in the long term. The fall in public expenses exceeds the fall in revenues. Transfer payments and public wage-expenses decline as hourly wages fall. Other public expenditures also fall as prices fall. Tax revenues from personal income taxes fall immediately when hourly wages fall. But the number of tax payers increases and offsets some of the fall in tax revenue. Other tax revenues also decline through the effect on prices.

The negative long-term impact on consumption should be seen in relation to two things: the absence of a fiscal reaction function and the size of the foreign trade elasticities. The increase in the labor force expands the tax base and improves public finances permanently. If the improvement was returned in the form of tax reductions, consumption would increase. If the foreign trade elasticities were higher, the necessary fall in terms of trade and real wages would be smaller and consumption would respond less negatively. In general, a permanent increase in the labor force has a permanent positive effect on employment and output. This provides higher tax revenue for the government and a potential for higher public spending or lower taxes, which in turn could boost domestic demand and moderate the need for higher exports.

Figure 10. The effect of a permanent increase in labor supply with 27000 people