Here the efficiency of capital and labor is increased, which leads to a fall in the demand for both factors. The experiment produces a general reduction in production costs, therefore, a long run gain in foreign trade and domestic production.

The efficiency of labor and capital is permanently raised by 1 percent . (See experiment)

Table 13a. The effect of a permanent increase in labor and capital efficiency

1. yr

2. yr

3. yr

4. yr

5. yr

10. yr

15. yr

20. yr

25. yr

30. yr

Million 2010-Dkr.

Priv. consumption

fCp

1203

1271

1027

1238

1662

4182

6652

8999

10899

12117

Pub. consumption

fCo

5824

5885

5962

6028

6086

6390

6800

7313

7909

8571

Investment

fI

-1847

-2675

-1450

-251

702

3351

4200

4101

3597

3014

Export

fE

2940

4910

6730

8551

10278

17212

20290

20137

18582

17349

Import

fM

62

75

824

1738

2581

5883

7980

8993

9239

9124

GDP

fY

7855

9039

11192

13622

16024

25238

29993

31633

31870

32078

1000 Persons

Employment

Q

-9,33

-10,09

-9,08

-7,31

-5,27

3,43

6,51

5,35

2,59

0,08

Unemployment

Ul

5,44

5,11

4,55

3,67

2,66

-1,76

-3,39

-2,82

-1,39

-0,07

Percent of GDP

Pub. budget balance

Tfn_o/Y

-0,18

-0,18

-0,13

-0,09

-0,05

0,13

0,19

0,16

0,12

0,07

Priv. saving surplus

Tfn_hc/Y

0,10

0,12

0,08

0,04

0,00

-0,09

-0,08

-0,05

-0,02

0,00

Balance of payments

Enl/Y

-0,07

-0,06

-0,05

-0,05

-0,04

0,05

0,11

0,12

0,09

0,07

Foreign receivables

Wnnb_e/Y

0,07

0,08

0,05

0,02

-0,02

-0,01

0,28

0,65

0,96

1,16

Bond debt

Wbd_os_z/Y

0,23

0,43

0,56

0,64

0,67

0,24

-0,59

-1,30

-1,70

-1,82

Percent

Capital intensity

fKn/fX

-0,37

-0,48

-0,60

-0,71

-0,79

-0,97

-0,90

-0,73

-0,58

-0,48

Labour intensity

hq/fX

-0,67

-0,76

-0,83

-0,88

-0,91

-0,95

-0,94

-0,94

-0,95

-0,95

User cost

uim

-0,36

-0,42

-0,47

-0,53

-0,57

-0,66

-0,57

-0,43

-0,31

-0,25

Wage

lna

-0,25

-0,41

-0,55

-0,68

-0,78

-0,86

-0,50

-0,07

0,23

0,34

Consumption price

pcp

-0,37

-0,47

-0,56

-0,63

-0,70

-0,87

-0,83

-0,69

-0,56

-0,49

Terms of trade

bpe

-0,29

-0,36

-0,42

-0,48

-0,53

-0,63

-0,58

-0,47

-0,38

-0,33

Percentage-point

Consumption ratio

bcp

0,02

0,04

0,02

0,01

0,01

0,03

0,03

0,03

0,04

0,06

Wage share

byw

-0,13

-0,19

-0,24

-0,27

-0,28

-0,22

-0,08

0,02

0,06

0,05

(See details)

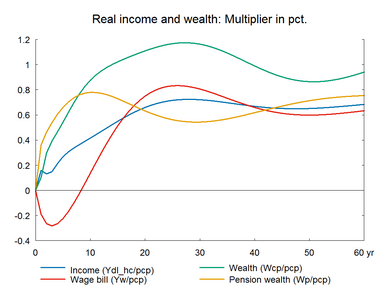

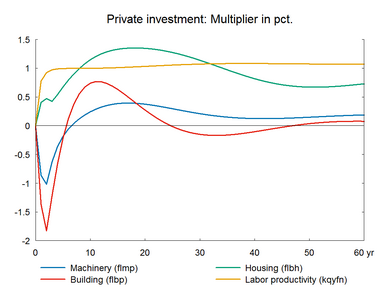

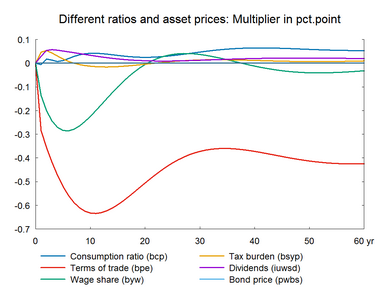

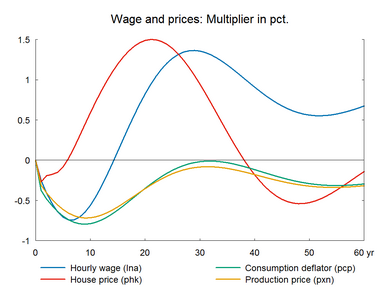

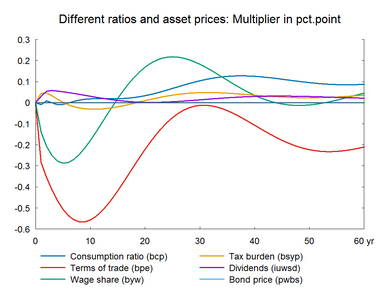

Higher efficiency of labor and capital means that both factor inputs can be reduced, consequently investment and employment fall in the short term. The fall, particularly in machinery investment, reduces imports and depreciation, which increases gross operating surplus. As factors' efficiency increases, prices fall and net exports increase without relying on change in wages. Higher net exports increase production and employment. This offsets the initial fall in employment created by the increase in labor efficiency.

The initial fall in employment pushes wages and prices downward. This improves competitiveness and induce exports to rise even more. As in the previous experiment, the combined effect of higher efficiency and lower wages means that the short-term decrease in factor utilization disappears relatively quickly and the initial negative impact on employment is reversed quickly. In the long term, capital intensity and labor intensity fall by approximately 1 percent, excluding the housing sector.

There is a small positive impact on private consumption in the long run, due to the positive impact on real disposable income, which is stimulated as the higher productivity increases the real income of transfer recipients. The public budget improves in the long term.

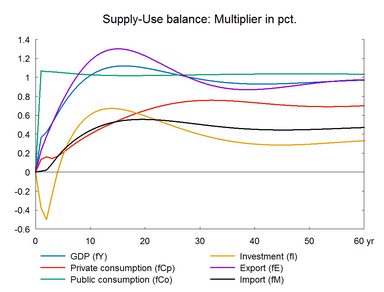

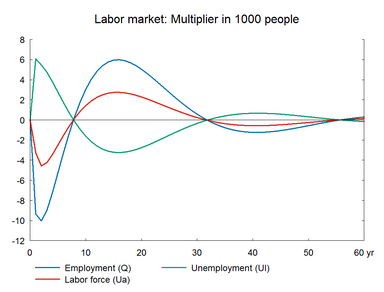

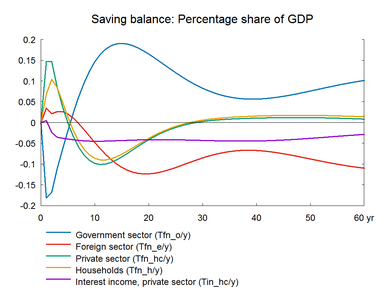

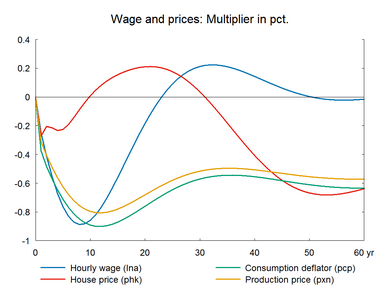

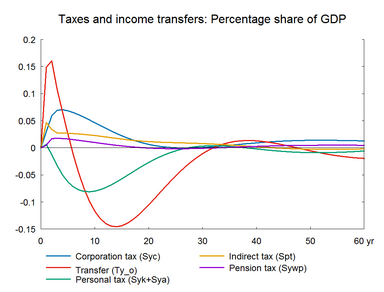

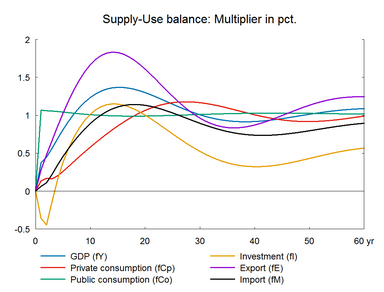

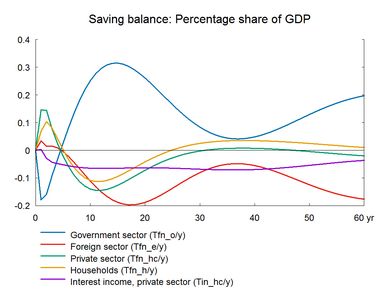

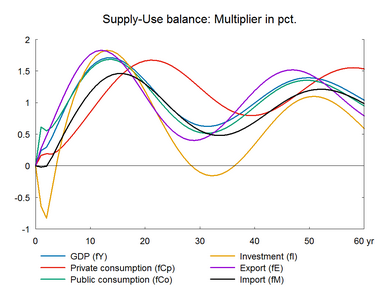

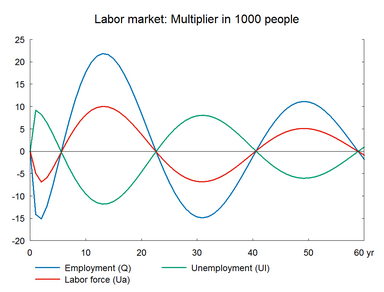

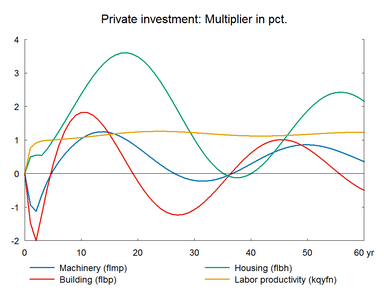

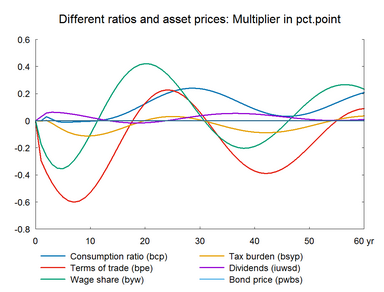

Figure 13a. The effect of a permanent increase in labor and capital efficiency

The experiment in section A is repeated accompanied by improved export performance. (See experiment)

Table 13b. The effect of a permanent increase in labor and capital efficiency, with supply effects

1. yr

2. yr

3. yr

4. yr

5. yr

10. yr

15. yr

20. yr

25. yr

30. yr

Million 2010-Dkr.

Priv. consumption

fCp

1206

1341

1224

1614

2261

6468

11109

15289

18025

18900

Pub. consumption

fCo

5823

5877

5943

5997

6040

6251

6586

7084

7727

8469

Investment

fI

-1763

-2398

-906

550

1780

5806

7403

7068

5589

3842

Export

fE

3584

6167

8661

11230

13738

24188

28279

26059

20835

16537

Import

fM

681

1127

2422

3935

5414

12066

16563

18197

17505

15798

GDP

fY

7966

9587

12257

15264

18297

30674

36923

37512

34972

32291

1000 Persons

Employment

Q

-9,26

-9,65

-8,15

-5,82

-3,17

8,44

12,20

8,98

2,82

-2,55

Unemployment

Ul

5,40

4,86

4,04

2,87

1,54

-4,39

-6,39

-4,74

-1,53

1,30

Percent of GDP

Pub. budget balance

Tfn_o/Y

-0,18

-0,18

-0,11

-0,06

0,00

0,25

0,33

0,28

0,18

0,08

Priv. saving surplus

Tfn_hc/Y

0,10

0,12

0,07

0,03

-0,01

-0,13

-0,13

-0,09

-0,05

-0,02

Balance of payments

Enl/Y

-0,07

-0,05

-0,04

-0,03

-0,01

0,12

0,20

0,18

0,12

0,06

Foreign receivables

Wnnb_e/Y

0,06

0,07

0,04

0,01

-0,01

0,16

0,74

1,44

1,97

2,26

Bond debt

Wbd_os_z/Y

0,23

0,42

0,52

0,55

0,52

-0,37

-1,79

-2,96

-3,50

-3,47

Percent

Capital intensity

fKn/fX

-0,39

-0,52

-0,66

-0,79

-0,90

-1,12

-0,97

-0,65

-0,35

-0,18

Labour intensity

hq/fX

-0,69

-0,79

-0,87

-0,93

-0,97

-1,04

-1,05

-1,04

-1,03

-1,03

User cost

uim

-0,36

-0,42

-0,48

-0,53

-0,57

-0,60

-0,40

-0,12

0,07

0,13

Wage

lna

-0,25

-0,41

-0,54

-0,64

-0,72

-0,53

0,24

1,04

1,51

1,53

Consumption price

pcp

-0,37

-0,47

-0,55

-0,62

-0,68

-0,76

-0,55

-0,25

-0,01

0,08

Terms of trade

bpe

-0,29

-0,36

-0,42

-0,47

-0,51

-0,55

-0,39

-0,16

0,00

0,04

Percentage-point

Consumption ratio

bcp

0,02

0,03

0,01

-0,01

-0,01

0,01

0,02

0,05

0,09

0,13

Wage share

byw

-0,13

-0,20

-0,25

-0,27

-0,28

-0,17

0,05

0,21

0,25

0,20

(See details)

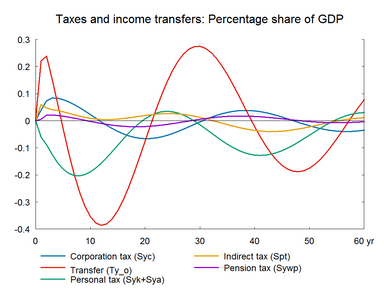

Figure 13b. The effect of a permanent increase in labor and capital efficiency, with supply effects

The experiment in section B is repeated, where the income tax rates are reduced to balance the public budget. (See experiment)

Table 13c. The effect of a permanent increase in labor and capital efficiency, with supply effects, balanced budget

1. yr

2. yr

3. yr

4. yr

5. yr

10. yr

15. yr

20. yr

25. yr

30. yr

Million 2010-Dkr.

Priv. consumption

fCp

1387

1398

1208

1642

2456

9041

17228

22956

23124

18419

Pub. consumption

fCo

3379

3100

3467

4167

5037

9515

11189

9302

5965

4114

Investment

fI

-3066

-4240

-2126

97

2053

8915

11013

8216

2900

-1249

Export

fE

3526

6158

8820

11642

14448

25546

26434

18176

9080

7421

Import

fM

-227

-177

1387

3370

5408

15259

21193

20455

14839

9323

GDP

fY

5286

6343

9774

14032

18537

37848

44911

38631

26755

19784

1000 Persons

Employment

Q

-13,96

-15,00

-12,38

-8,20

-3,37

17,58

21,00

8,39

-7,84

-15,92

Unemployment

Ul

8,14

7,59

6,10

3,98

1,54

-9,17

-10,98

-4,44

4,04

8,30

Percent of GDP

Pub. budget balance

Tfn_o/Y

-0,14

-0,14

-0,09

-0,04

0,00

0,20

0,23

0,12

-0,03

-0,11

Priv. saving surplus

Tfn_hc/Y

0,10

0,13

0,08

0,03

-0,02

-0,15

-0,17

-0,13

-0,06

0,00

Balance of payments

Enl/Y

-0,04

0,00

-0,01

-0,01

-0,01

0,04

0,05

-0,02

-0,10

-0,11

Foreign receivables

Wnnb_e/Y

0,21

0,30

0,29

0,23

0,16

-0,17

-0,26

-0,20

-0,14

-0,07

Bond debt

Wbd_os_z/Y

0,26

0,44

0,52

0,53

0,48

-0,43

-1,66

-2,29

-2,04

-1,24

Percent

Capital intensity

fKn/fX

-0,29

-0,42

-0,62

-0,80

-0,96

-1,30

-0,95

-0,30

0,18

0,21

Labour intensity

hq/fX

-0,73

-0,84

-0,92

-0,96

-0,99

-1,00

-0,98

-1,01

-1,06

-1,09

User cost

uim

-0,42

-0,53

-0,62

-0,68

-0,73

-0,61

-0,12

0,32

0,39

0,11

Wage

lna

-0,29

-0,52

-0,72

-0,87

-0,95

-0,41

1,08

2,24

2,29

1,38

Consumption price

pcp

-0,38

-0,51

-0,61

-0,70

-0,76

-0,74

-0,27

0,22

0,40

0,18

Terms of trade

bpe

-0,30

-0,39

-0,47

-0,53

-0,57

-0,53

-0,17

0,17

0,26

0,06

Percentage-point

Consumption ratio

bcp

0,04

0,05

0,02

0,00

-0,01

-0,02

0,03

0,15

0,25

0,25

Wage share

byw

-0,17

-0,25

-0,31

-0,34

-0,35

-0,10

0,28

0,45

0,31

0,03

(See details)

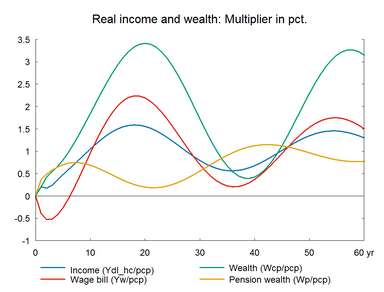

Figure 13c. The effect of a permanent increase in labor and capital efficiency, balanced budget